Azerbaijan’s auto market in 2021 falls 16% with 4,170 sales, reporting a mixed performance during the year. Lada consolidates its leadership position, reaching a huge 46.3% market share.

Market Trend

Azerbaijan’s car market this year was unable to recover effectively from the pandemic, and reported a mixed performance.

The introduction of new rules regarding the import of pre-owned and new vehicles has fast transformed the domestic industry in these years. Indeed, while the market was opened to import of any type of vehicles and the 90% of import was focused on used vehicles, with a huge number of almost old premium brands imported from Russia and Europe, the recent approach is to limit the import and sustain the opportunity to create a national automotive industry.

In 2019 the car market was pushed up by the success of the new local brand “Khazar” established in 2018 and based on technology imported from Iran.

Thanks to a short lineup based on three models, a sedan and hatch C class model and a D class sedan based on the Peugeot 404 old model, the new brand is able to deliver low-cost models intercepting demand from the used vehicles and middle class. As a result, in 2019 the market scored the highest number of sales with 10,598 units sold.

Because of the COVID-19 pandemic sales significantly decreased in 2020. In fact, sales have been 4,548, reporting a fall of 57.1% compared to 2019.

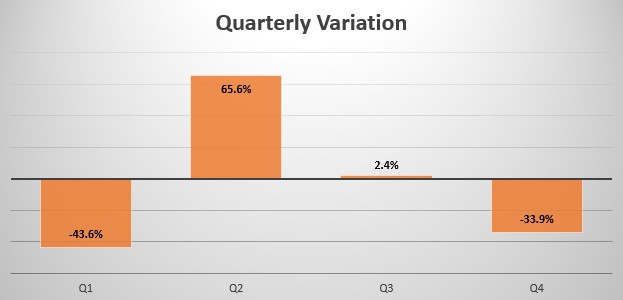

In 2021 the year started negatively for the Azerbaijan market, in fact, in Q1 882 units have been sold, reporting a 43.6% decrease in sales compared to Q1 2020, while in Q2 sales kept accelerating due to the incredibly low levels of the previous year, reporting a 65.6% increase with 1.070 units sold.

In Q3 1,124 units were sold, reporting a small 2.4% gain, while in Q4 sales dropped again in double-digits, losing 33.9% with 1,094 units sold.

Indeed, Full-Year sales for 2021 have been 4,170, reporting a 16% decrease compared to 2020.

Brand-wise, this year the leader Lada held a huge 46.3% market share, followed by the local brand Khazar which held 16.3% market share. Hyundai was in the third position and held 6.8% share.

The most sold model in the country is the Lada Vesta, holding 17% market share.