Myanmar car market in 2021 drops 68.1% with 5,008 sales, reporting an extremely sharp drop after the coup d’état. Leader Suzuki maintains 37.4% share.

Economic Environment

Prospects were dim in H2. The manufacturing PMI remained in contractionary territory, suggesting a weak industrial sector, while imports were down on 2020, hinting at tepid spending. That said, momentum likely improved toward the end of the year as Covid-19 cases fell from July’s peak and the currency recovered some earlier losses, with the PMI moving close to growth in December.

Turning to the new year, armed conflict continues, and a recent massacre of civilians by the army and the sentencing of former leader Suu Kyi to prison threaten further Western sanctions. In addition, a new internet tax effective from January threatens economic damage, with a recent estimate suggesting internet outages in 2021 already cost the country USD 2.8 billion. More positively, the RCEP trade deal came into force and the EU lifted rice tariffs in January, which should boost the external sector somewhat.

Market Trend

Myanmar’s car market this year fell sharply all year, especially after Q2.

The reduction of import fee on new vehicles and the barrier to extra ASEAN used vehicles import, gave more competitiveness to the new models and data on new vehicles registrations become almost positive, with the full year 2018 sales boomed at the all-time record of 18.500 units, sixth time more than in 2013.

The growth was driven by the fast growth of the new local industry with the availability of locally made models offered at an affordable price, with great success for Ford (Ranger and Everest) and Suzuki (Ertiga, Carry, Ciaz).

Following the recent years of rapid growth, in 2019 the market struggled for the first three quarters, but the strong demand in Q4 allowed a recovery with final figures up 5.6% at 19.537, the new all-time record.

Sales in 2020 have been influenced by the COVID-19 pandemic, impacting all sectors. In fact, 15.721 units have been sold, reporting a decline of 19.5%.

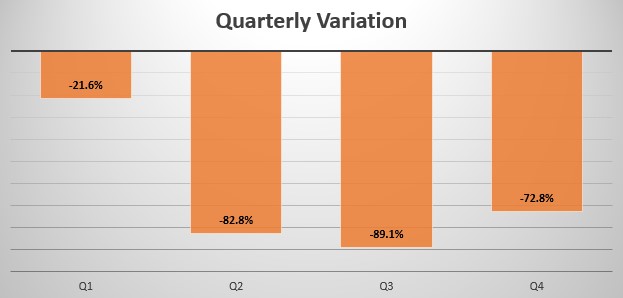

The market started the new year negatively, in fact, sales fell 21.6% with 3,113 units were sold, while in Q2 sales dropped 82.8% with only 545 units sold.

In Q3 sales remained down 89.1% with 659 units sold, and did not improve much in Q4 when 691 units were sold (-72.8%).

Indeed, Full-Year sales for 2021 have been 5,008, reporting a 68.1% decrease compared to 2020.

Brand-wise, this year the leader Suzuki (-82.5%) lost an impressive 4.5% market share, followed by Toyota (-74.3%), which gained 4% share. Ford (-63%) reached 4th place and gained 6.6% market share.

The most sold model in the country is the Suzuki Swift, which lost 37.1%, holding 14.4% share.