Turkish Auto market in 2021 falls by 4.4% with 738,929 sales, reporting a very strong first half, followed by a double-digit fall in the second part of the year. Hyundai reports the best performance, gaining 35%.

Market Trend

The Turkish car market this year attempted to recover from the pandemic crash of 2020 and reported a very promising performance in the first half, followed by a steep double-digits fall, leading to negative YoY performance.

The automotive industry is one of the largest industrial sectors in Turkey and is the hub for several European and Japanese manufacturers that invested in production facilities to cover the domestic demand while exporting in Europe, the Levant, and North Africa.

In the last decade, the stability of the market has been compromised with strong fluctuations of the Turkish lira which have changed the convenience to export while the domestic market is heavily dependent on the economic trend which suffers from the political structure.

Looking at recent years of domestic market trends, it is easy to see a strong crisis hitting the market periodically. After registering a sharp drop in 2014 – and recovering in the following years – in the second part of 2017 a new crisis approached the market and in 2018 it collapsed by 35.1%, followed by a 21.2% drop in 2019, due to negative economic environment.

Despite the COVID-19 pandemic sales increased in 2020. In fact, sales have been 772,788, reporting an increase of 58% compared to 2019.

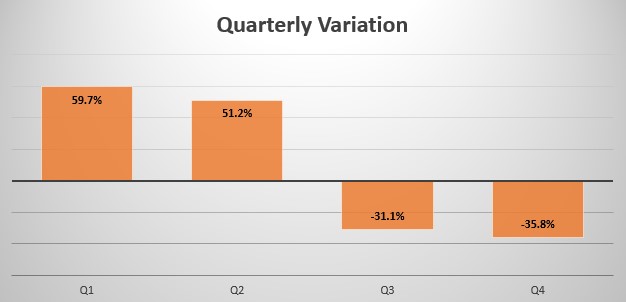

In 2021 the year started positively for the Turkish market, in fact, in Q1 198,660 units have been sold, reporting a 59.7% increase in sales compared to Q1 2020, and in Q2 sales remained positive, reporting a 51.2% increase in sales with 196,041 units due to the incredibly low volumes in Q2 2020.

In Q3 sales started falling quickly, losing 31.1% with 165,023 units, and in Q4 this trend continued, losing 35.8% with 179,205 units.

Indeed, Full-Year sales for 2021 have been 738,929, reporting a 4.4% decrease compared to 2020.

Brand-wise, this year the leader Fiat (-11.7%) lost 1.4% market share, followed by Renault (-19.9%), which lost 2.1% share. Volkswagen -up 1 spot- on the other hand, gained 0.8% share, rising 5.3%. Ford (-27.3%) fell in 4th place reporting the worst performance, followed by Toyota which gained 34.2%.

Peugeot lost 10.8%, followed by Hyundai (+35%) -up 2 spots- which reported the best performance, and Dacia which gained 13.2 sales. Closing the leaderboard we have Citroen -up 1 spot- gaining 4.7% this year, while Honda entered the leaderboard by jumping 2 spots, gaining 26.7% sales.

The most sold vehicle this year remains the Fiat Egea (-20.9%) with 71,678 units sold, followed by the Toyota Corolla, which gained 23.1% registering 41,824 new sales this year. The Renault Clio (-28.9%) closes the podium and reports 35,288 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands and top 10 Manufacturers Groups.